by Elias, Velu and Ponnappa

Why do companies require role of CFOs more than ever now?

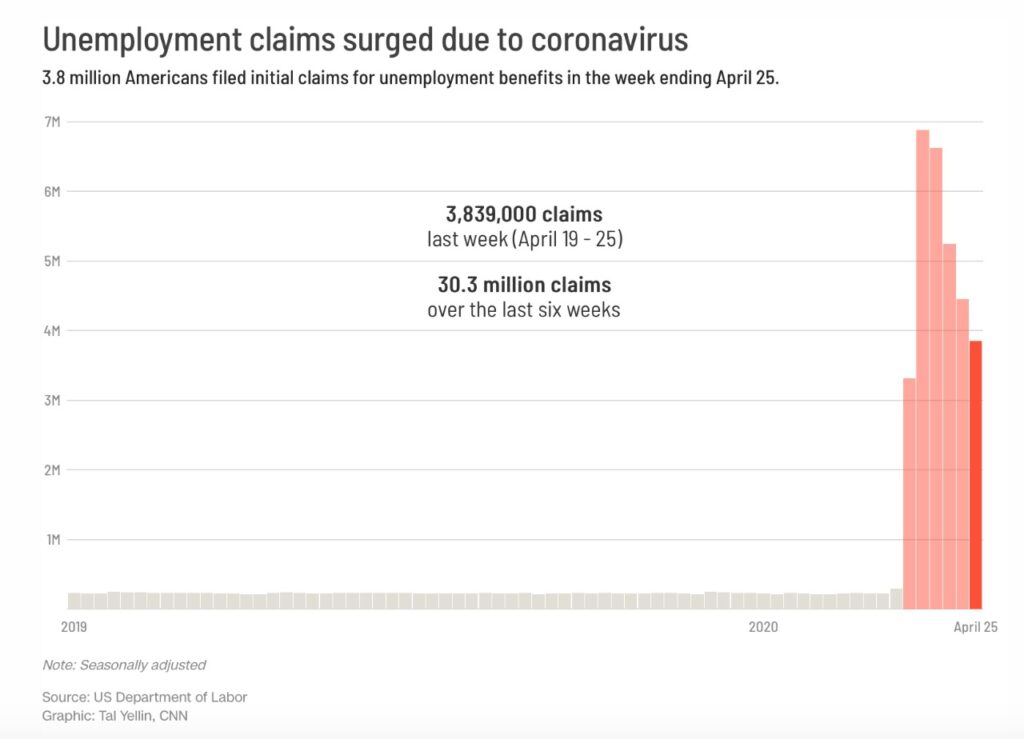

The Coronavirus has been one of the worst economic crises in the century to hit almost every nation, with the reports coming from US until 30 April, 2020, ‘about 30 million have filed for initial unemployment and benefit claims’.

Centre for Monitoring Indian Economy {CMIE) said ’27 million youth in the age group of 20-30 years lost their jobs in April 2020 following a nationwide lockdown to prevent the spread of Covid-19′.

Many of the companies have lost more than 75% of their yearly profits in the first quarter of 2020 say most reports. Many companies are resorting to quick-fix measures such as laying off staff, while others are trying to cope by curtailing costs and encouraging their employees to work from the safety of their homes.

Can, a routine application of an option such as this, help the worst world pandemic situation, which is dwindling the world economy.

Companies are the source of any nation’s economic upheaval. The question is during this troubled times, who can bell the cat? Can the CEOs on whom rest the pillars of companies answer the cry? May be and may be not…but they should eventually…

But the CFOs can be a surprise pack with a redemptive action during this Covid times.

The coming years will be the years of CFOs for sure, provided they respond to the critical areas of importance such as ;

- Cost Containment Vs Cost Optimisation

- Protect Cash flow and build-on Reserves

- Create a long term Growth Value Post Covid 19 era

- Create a Top Down Communication Mechanism

1. Cost Containment Vs Cost Optimisation

With an aim to protect and strengthen cash reserves, it is possible that most CFOs may directly focus on Cost Optimization mechanisms, which are part of long term strategies and are long term value creation models of a company. They may not be the immediate need of the time.

The short term focus is to be a de-risk mechanism, executed purely by cost containment measures, that directly affect business performance.

Cost containment can be by way of discretionary spending on the following

- Reduce on travel, meetings, celebrations and food, and entertainment

- Reduce on office space with work from home option in place

- Renegotiate on property rentals

- Relook on marketing expenses

- Freeze of hire and non-replacement of vacancy unless vital

- Deferment/ renegotiation of fixed period contracts

- Introduce Flexible pay for employees

- Pay cuts should be last option resorted to… only on urgent requirement

The real and immediate focus has to be on how to cut and how much to cut.

But the thing to realise is sustainable cost reduction requires lasting business partnership. It cannot be isolation.

Thus the CFOs have to really think out of box to employ cost containment options. And such Cost Containment exercise has to be strategic.

a. Strategic implementation of Cost-Containment Measures

Realty proves that 81% of cost reduction targets have simply been missed in the last financial year, as stated by CFO, Daily news.

What is to be done

- Underline under performing assets and act

- Streamline business processes

- Improve policy compliance

- Leverage scale to source purchased materials/services

- Centralise to integrate business units and functions

b. Cost Containment and Growth

The immediate step for CFOs is to protect profitability and ongoing cash flow. Such a move is crucial due to uncertainty in business cycles, vulnerability of markets and New Govt Regulations that are untested and untried during these covid times.

The right balance between cost and growth are a must for CFOs, while cost-containing. While focusing on cost factors, they cannot set eyes off the growth factor even in short terms. New opportunities may arise out of covid crisis. The current competitive landscape may change. Thus it is very important for them understand the behaviour of the market and its preference, while employing cost-containing measures.

The right balance between cost and growth are a must for CFOs, while cost-containing. While focusing on cost factors, they cannot set eyes off the growth factor even in short terms. New opportunities may arise out of covid crisis. The current competitive landscape may change. Thus it is very important for them understand the behaviour of the market and its preference, while employing cost-containing measures.

2. Protect Cash flow and build-on Reserves

Cash flow is the life-blood of any business. There must be an inflow and outflow of cash for optimum business health. While focusing on cost containment, it is highly important for CFOs to keep building on the surplus during Covid moment.

a. Constant review of inventory Management

CFOs must reduce the inventory costs without sacrificing the quality of goods sold or inconveniencing the customers. Pricing and credits terms are to be watched very carefully to scale on inventory management

b Lowering cost structures

With the revenue falling by half, It is absolutely essential for CFOs to ensure that cost structures generally operate between 70-80% . Cost of good sold should be bought down heavily.

c. With focus on profit and cash positive Products/services

Without damaging core business, the CFOs must play a crucial role in germinating profits from other diversified products or services. At the same time, The CFOs must not deviate from core business and brand image and reputation.

d. Check on Credit Scores

Borrowing must be watched very carefully, particularly for business with iffy credit ratings. The CFOs must be on the top of them most of the time.

e. Watch for Red Flags

While focusing on Cash, it is highly imperative for CFOs to pay due attention to red flags, such as slow paying receivables and tightening credit lines.

f. Benefiting from Govt Packages/initiatives

The CFOs must watch and guide management on deferment of loan option and interest payment. They must take advantage of temporary benefits extended by the Govt relating to PFs, GST, TDS etc…

3. Creation of a long term Growth Value Post Covid 19 era

CEOs and CFOs find themselves many times in a ‘splits’ between short term financial performance and long term value creation. This is where, the CFO must learn to partner with the CEO and business leaders to proactively address the dilemma.

CEOs and CFOs find themselves many times in a ‘splits’ between short term financial performance and long term value creation. This is where, the CFO must learn to partner with the CEO and business leaders to proactively address the dilemma.

In my experience and learning curve, I have seen many CFOs relentlessly fall victim to arresting the immediate operational than truly financial. And most of the time, this fire fighting mode continues with no solution in place.

It cannot be so at this time …in the post covid era

The CFO’s role here must to be to ensure on the following

- To drive organisational focus on growth by evaluating existing business models and its structures

- To alter or innovate new business models to drive organisational focus

- To ensure a solid financial redemptive foundations that includes financial systems, processes and projects

- To monitor company’s available resources from internal cash flows and investment from third parties in new projects or ventures

- To determine new opportunities and redirect financial resources to improve and scale on business for the future

- To move towards long term contracts that yield value add results for the future

To attract exciting acquisition and alliance opportunities, and make them part of long term value creation

4, Top down Communication

At times of change and crisis, it is important for CFOs to optimise relationships with all the key stake holders in the company from top to down with a communication plan

They can’t function in isolation, as they once were. They need to be, part of the integral running of the company and its projects, also with the clients.

Top-Mid -Bottom level (end to end) communication is absolutely critical to success. The goal is to retain business confidence and avoid surprises.

The CFOs need to engage the stakeholders in positive dialogue about the crisis and opportunities in hand. They must learn to employ good stakeholder management strategy in executing their thought in action.

They need to find ways and means of addressing the underlying weaknesses that post a threat to change management practises.

Such a communion must focus on two aspects

- It is not merely to manage the customers, investors and stakeholders, but to make them as value-add partners in the phase of change and growth.

- It is to ensure that actions taken are understood, supported and sustainable through effective stockholder management practices across the company

Gartner’s Efficient Growth research from the performance of the larger 1142 public companies by market capitalisation in the S&P Global 1200 index from 2010 to 2018, states, “only 5% achieved Efficient Growth Status, and those were the ones with long term revenue growth mechanisms, long-term cost reduction and short term simultaneous growth and margin expansions.

There is no doubt that the during worst economic crisis period of Covid-19, the CFO’s have to play a middle path, as channel partners between CEOs and the Management.

They must be the ‘financial voice of conscience’ to the CEOs and the Management team. The CFOs need to be strategic partner with the CEOs in creating lasting value not only for the stakeholders but the entire business.

For the company to step either into New Normal or No Normal, It is in the hands of CFOs today.

About the Writers

Elias Moses is a Senior Business Strategist, Researcher, Corporate and Leadership Trainer, Orator, Columnist and an Entrepreneur. He is also the Founder and Managing Director of a growing reality firm in south India. The author can be contacted@

email: elias@manovsis.com, linkedin: www.linkedin.com/in/eliasmoses

Velu A is a Chartered Accountant and a Management Expert with 18 years of professional experience in areas of strategic planning, budgeting, MIS reporting, fund raising. He is a CFO of a limited Company of great legacy in India

Ponnappa is a Charted Accountant with 19 years of Professional Experience in op. restructuring. Taxation, Acquisitions, Divestments, Capital restructuring, Pricing, SCM. He is a CFO of a Company of great repute in India

One thought on “Years of CFOs – Why companies require the role of CFOs in Covid Era”

Excellent Article and very informative.

Comments are closed.