by Elias Moses

How can Indian Startups bounce back with time?

The Year 2019 was a hit for Startups in India, mainly as they drew the attention of international investors from across globe.

According to research firm Tracxn, 14.5 billion USD was raised in funding, a significant jump from 10.5 billion in 2019.

In 2019, four Indian startups joined the Unicorn club and got publically listed – OYO Rooms, Paytm and Udaan to start with.

Hitting the peak in 2019, the expectations got roof high for startups from 2020. Although the year began well, the novel Coronavirus dampened the startup spirits.

With many sectors coming to a halt, the startup budding ventures began anticipating the worst with severe liquidity crunch and with deep-pocketed global investors putting off some of the vital deals in making.

Factual Turn-around for Worst

What was a ‘good to go’, turned out to be a disaster with two months of lock down for start ups.

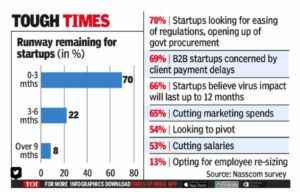

As per Nasscom, ‘About 70% of startups have cash less than three months and another 22% have cash for next six months’. With the revenue decline, about 60 of consumer facing start-ups are facing business closure.

As per Nasscom, ‘About 70% of startups have cash less than three months and another 22% have cash for next six months’. With the revenue decline, about 60 of consumer facing start-ups are facing business closure.

It will be ideal for the startups to have cash for 24 months to create a turn around, but in reality it is simply not possible. The fall in revenue has impacted not just the cash flow but the investor’s expectation.

The coronavirus pandemic has already made investors wary. In the first quarter of 2020 , VC investments fell sharply to just $2.2 billion, after garnering $6 billion in the last quarter of 2019, according to KPMG

The Startup Genome launched a survey that analysed the impact of the COVID-19 on startups globally, “around 74% of startups have been compelled to terminate full time employees. Out of these 39% of startups have laid off 20% or more of their staff, while 26% have handed the pink slip to over 60% of their staff”.

Most established start ups like Swiggly and Zomato have laid off thousands of employees as cost cut or cost-containment measures.

Venture capital and private equity investment in India expected to fall by 45%-60% this year, EY estimates

Just A matter of Survival

It is sad to hear stories from established startups talking about survival than redemption.

Pay cut, an option meant to be the last resort, has become a routine thing in times of crisis. ‘As a startup you have to survive, what would you do, if you don’t survive?, said a renowned startup firm.

As per Nasscom reports, upto 53% of the startups have had to announce pay cuts.

Cure.fit, a Bengaluru-based fitness firm which had to shut its gyms and health clinics around India, slashed salaries and laid off about 800 people in recent weeks. It is now trying to get by offering virtual yoga classes.

How to get into version 2.0

1. Work with New or Different Business models

About 54% startups are already thinking of changing their business models for good, mainly to adapt to changes and exceptions due to coronavirus.

Bangalore based apparel startup Turnswear has already moved to sell hand sanitisers and face masks to suit the market requirement.

BookMyShow, an online ticket seller, is promoting free-to-watch Instagram Live performances in an effort to keep its users engaged, while restaurant aggregator and food delivery firm Zomato is targeting a push into alcohol delivery.

2. Revamp Business Infrastructure

Many bangalore based service sectors have already moved to revamping their business structures apart from business models.

They have moved away from biometric based attendance system to GPS-based attendance application for both work from home and field staff.

GPS based attendance will be the way forward for industries in future.

3. Build a Cash Runaway

It is vital for Startups to build a cash runway for at least 18 months, i.e., till September 2021, an important pre-requisite to the restoration of any semblance of normalcy.

It is important to build a best/planned/worst-case scenario for their revenues and for their costs.

This will give them a 3×3 grid, into which they can tabulate their cash runway months using the combinations generated and then choose a suitable combination of revenue and cost scenario to plan ahead.

4. Early Course Correction on Projected Budget Numbers

Startups develop business models quite meticulously – eyeing market trends and potential, scalability, planning resources, operations, funding, contingencies, marketing, and much more.

What they need to do is not a not mid course correction, but a quarter course correction on the budget, which is simplistic and pragmatic.

5. Collaborate with other businesses

Startups have to employ the principle of co-work platform model. They need to work with the principle of affiliation. They have to find ways and means of collaborating with other local businesses or even competitors.

Startups have to employ the principle of co-work platform model. They need to work with the principle of affiliation. They have to find ways and means of collaborating with other local businesses or even competitors.

They need to provide a complementary offering and create more values for the customers. For e.g. Hummingbird collaborates with a popular local bakery during the lockdown, generating income for both parties.

6. Reassure investors with India’s Human Potentials

It is important for startups to reinitiate or reinstate the ‘investor friendliness’ by projecting India as a goldmine for any investor. Time to showcase India as

- the second-largest population in the world (second only to China which is closed to outside investments),

- More than 50 percent of its population is below the age of 25 and more than 65 percent below the age of 35.

- It is expected that, in 2020, the average age of an Indian will be 29 years.

- The lowest cost of data globally

- The second-largest smartphone population in the world

- Roughly 600 million monthly active customers accessing the world wide web Lowest levels of insurance penetration at 3.69 percent.

The Governments hard and stringent measures on stoping Chinese buying of Indian shares should not be seen as block to growth, it can be a boon for Indian investors very soon.

Startups success in the next 18 months won’t be determined by their growth or profitability, but merely by their ability to survive and not run out of cash. The old adage of ‘Cash is King’ has never rung truer.

Plans can perish, but Startups’ DNA must thrive

Elias Moses is a Senior Business Strategist, Researcher, Corporate and Leadership Trainer, Orator, Columnist and an Entrepreneur. He is also the Founder and Managing Director of a growing reality firm in south India. He is also the founder of Managing Next, an Online portal for knowledge share.

The author can be contacted@

email: elias@manovsis.com, linkedin: www.linkedin.com/in/eliasmoses

2 thoughts on “Indian Startups 2.0 post covid-19”

This is quiet a detailed study of the.current scenario and a very good analysis made. Reassure India is a great point. This blog can definately benefit a lot.of people who are lost in the process of fighting for their start up survival . Great article.. Keep going

thanks for the promising and encouraging feedback. our efforts such as these are planned aim at creating or imparting management practices to small and medium scale sectors. that people run their organizations professionally and methodically.

Comments are closed.